Table of Contents

2019 eCommerce trends: Download the full report here

The eCommerce cosmetics industry faces unique challenges when distributing their products within the online market. Brands are constantly grappling with how to inspire customers to purchase without the opportunity to experience the product for themselves. Meanwhile, cosmetics consumers increasingly grow more interested in purchasing beauty products over the internet, pushing eCommerce brands to discover new ways to build a user-friendly and compelling online shopping experience.

At Flowbox, we have expertise in the eCommerce industry and experience working with online cosmetics brands, and so we interviewed women across Europe to develop the most comprehensive report to date on what women look for while shopping online. Looking at features like customer reviews, how-to videos, and images of other customers using the products, we also examined how impactful devices such as discounts/promotions, purchasing conditions, and return policies are to conversions.

With this information, cosmetics brands will have the ability to make more informed decisions when designing and creating their online stores. To find these answers, first, we must first look at the main challenges that come up for eCommerce cosmetics brands.

After more than five years working within the eCommerce industry, continuously speaking with top brands and interviewing industry leaders, we developed five industry standard challenges that cosmetics brands face when taking to eCommerce. They help us to better understand how customers respond to the ever-changing world of online shopping and what modern day eCommerce trends are for cosmetics brands.

Those challenges are:

So with these five challenges in mind, we surveyed females who have purchased cosmetics within the past year within the UK, Germany, Spain, France and Italy to learn what eCommerce trends affect their cosmetics purchasing decisions.

To make the results as comprehensive as possible, this research addresses these challenges and our findings with four different questions:

By looking at buyer behavior within these five groupings, cosmetics brands will have a better understanding of how to use each to improve the online shopping journey of their online store through eCommerce trends.

There is a clear gap in our understanding of how customers purchase cosmetics on a large scale, one that accounts for multi-country analysis and that includes the newer techniques that online brands are using today. For that reason, we surveyed 1,500 women within the UK, Germany, Spain, France, and Italy to fill this gap in our knowledge.

Here, we’ve put together some of our key learnings, but you can download the full report here.

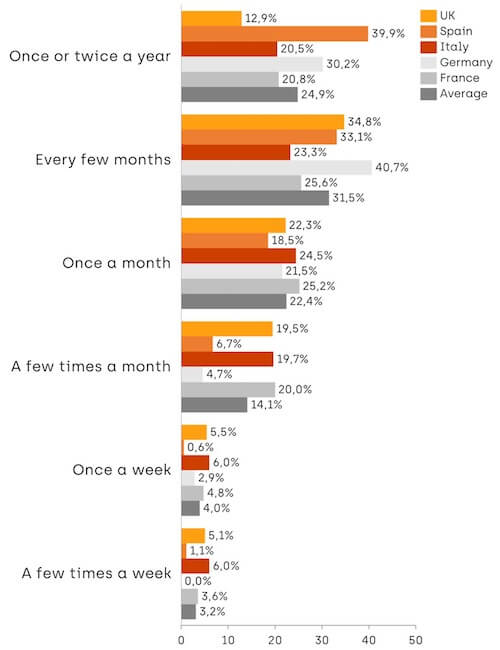

Key summary: Cosmetics products are generally not bought weekly or daily but over the span of months and on a rolling basis.

Key statistic: 73.9% of our respondents have bought cosmetics online in the last 12 months. (Data shown in full report)

Key learnings:

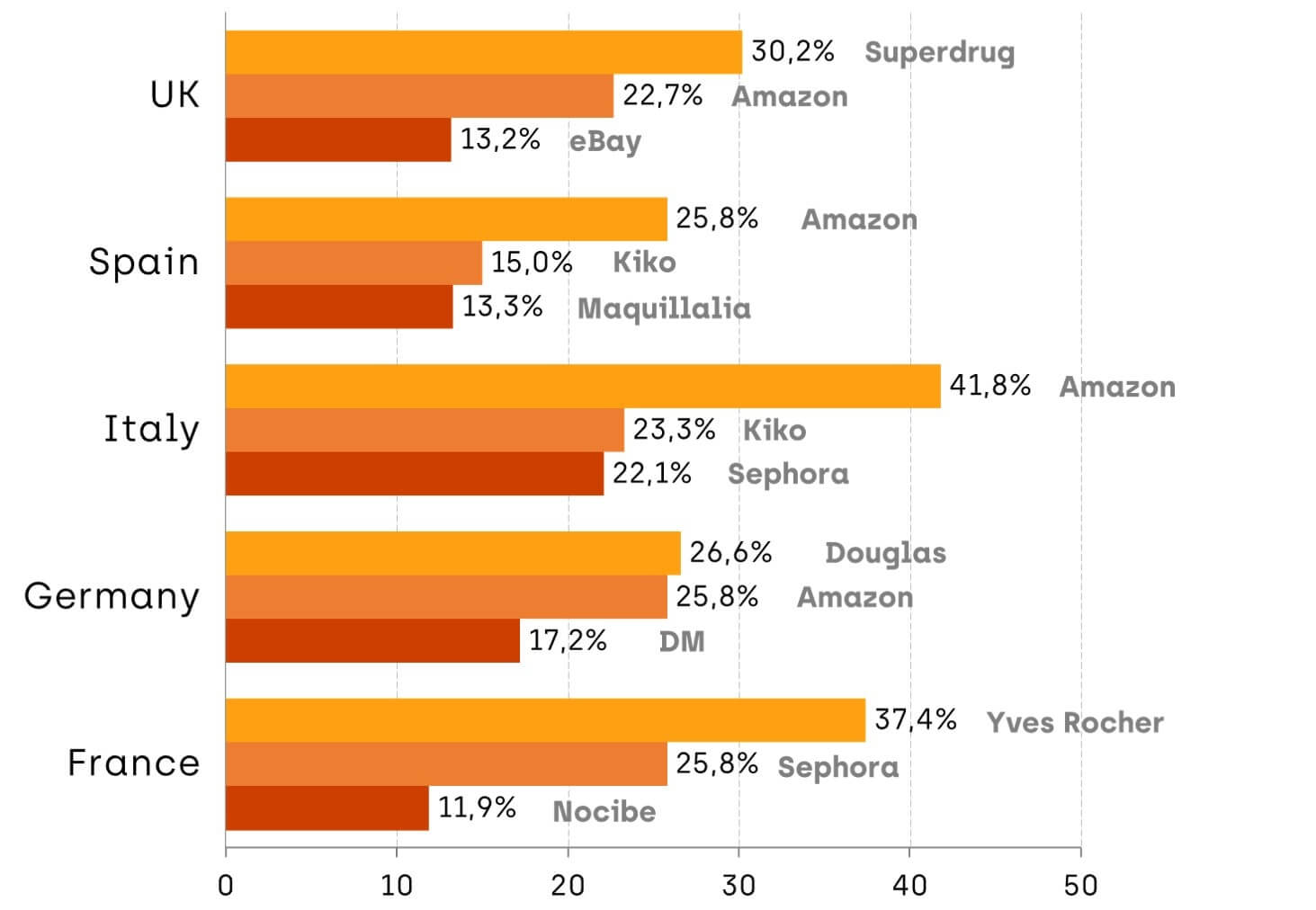

Key summary: European women tend to purchase their cosmetics products from big retail websites with various products more than from individual brand websites.

Key statistic: Amazon is one of the top three websites used to buy cosmetics online in all the countries surveyed except for France.

Key Learnings:

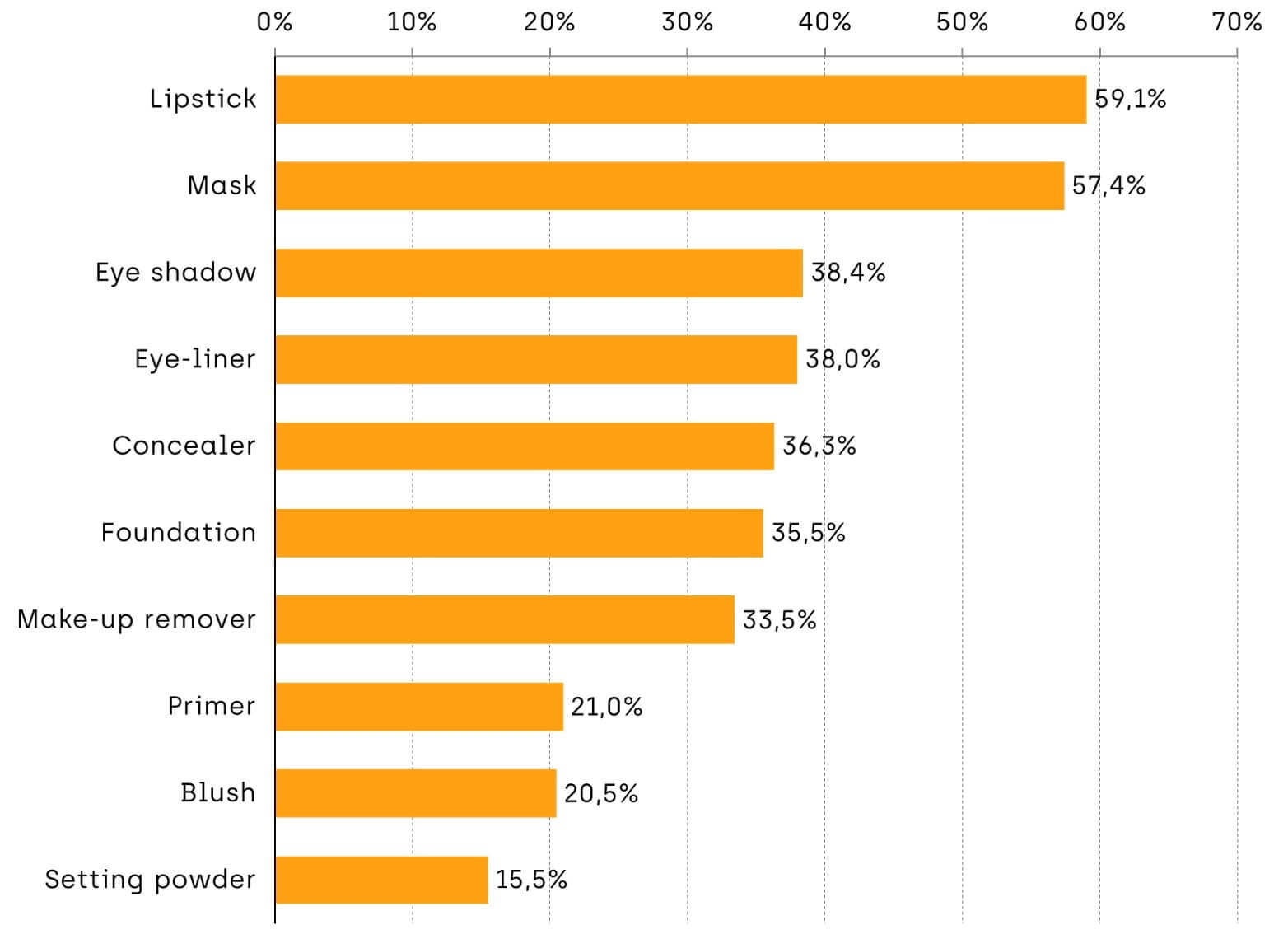

Key summary: Lipstick is the most popular product for purchasing online.

Key statistic: 30.4% of respondents considered sensitive skin products, followed closely by cruelty free products (30.1%), as the most important attributes when buying products online. (Download the full report to see this data)

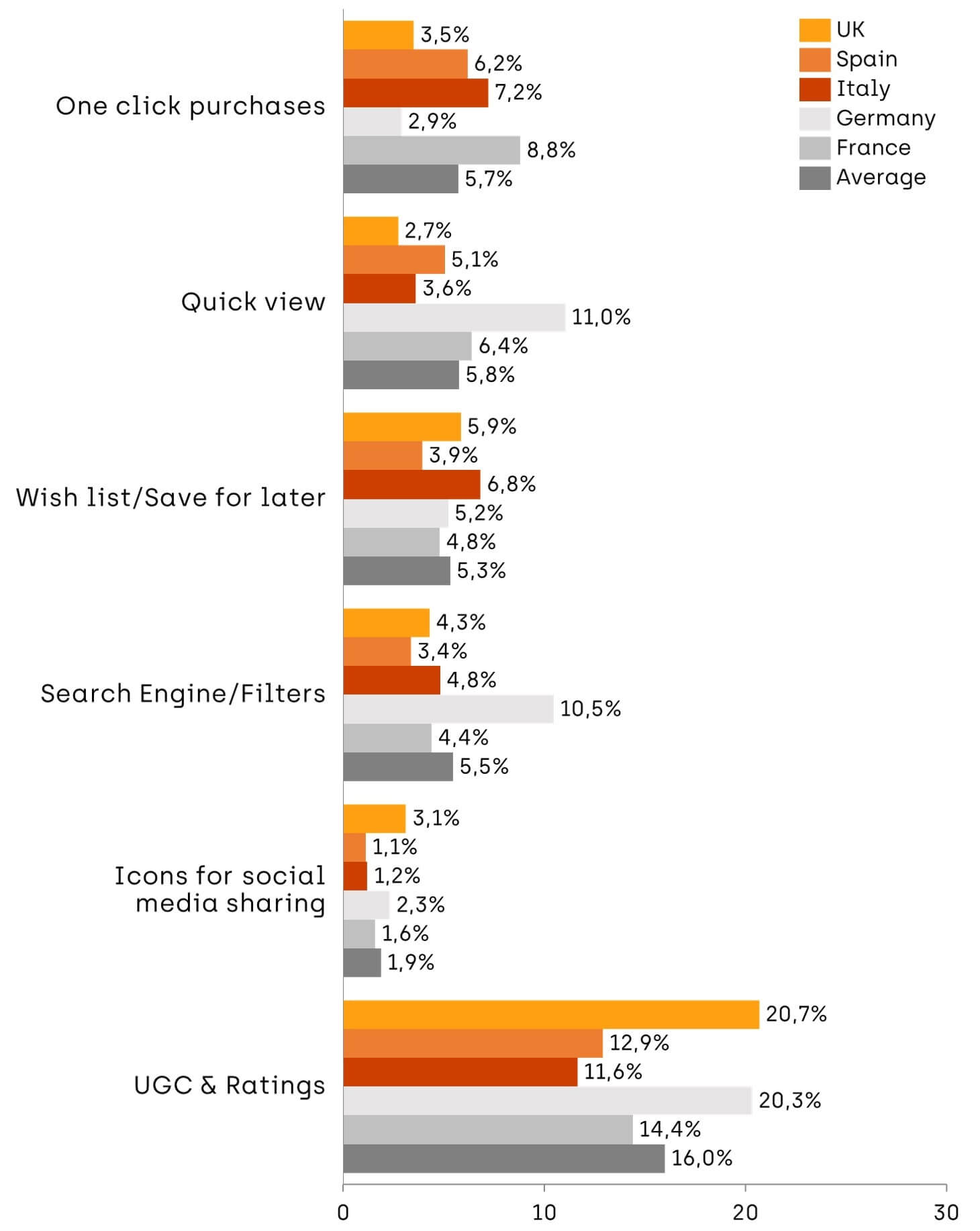

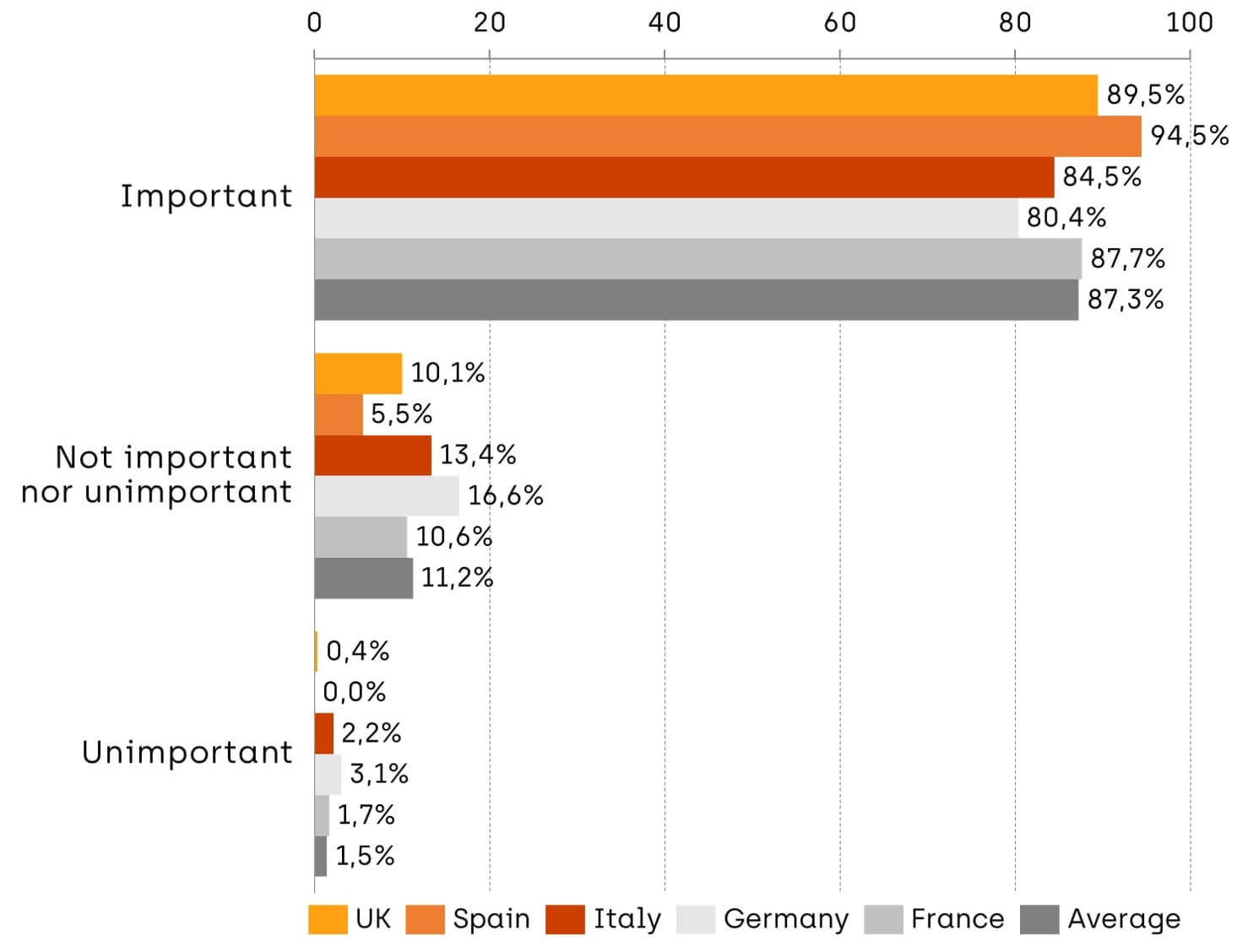

Key summary: All the countries tended to place more importance on the purchasing conditions rather than the website features when it came to having a good experience when buying cosmetics online.

Key statistic: When considering website features, UGC + star ratings scored the highest in all countries.

Key learnings:

Key Summary: Content created by users, both visual and written, was found to be a crucial aspect of the online shopping experience.

Key Statistic: When considering website features, UGC + star ratings scored the highest in all countries.

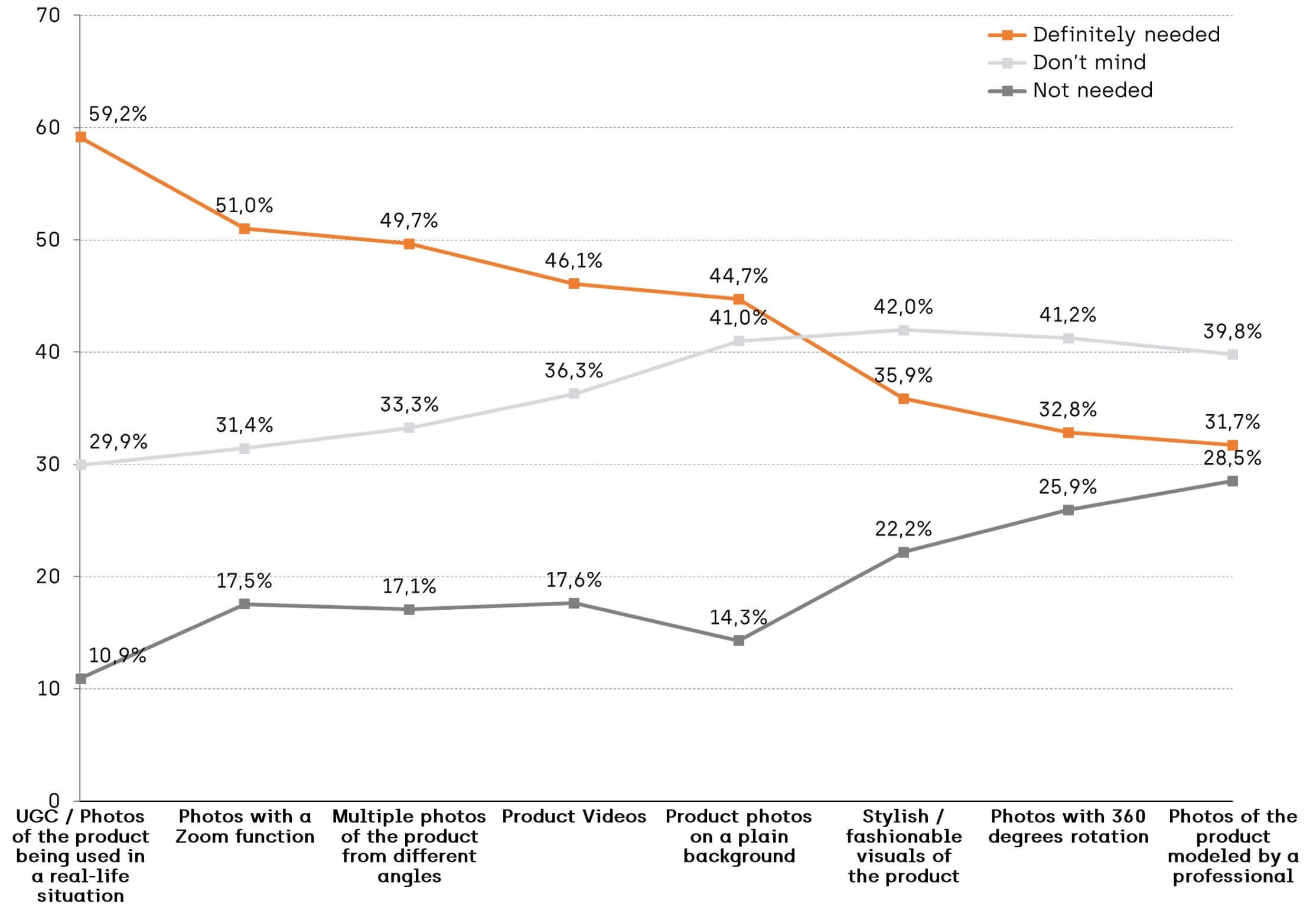

Key Summary: Respondents claimed that customer photos and photos of the product being used in a real-life situation are definitely needed to make online purchase decisions.

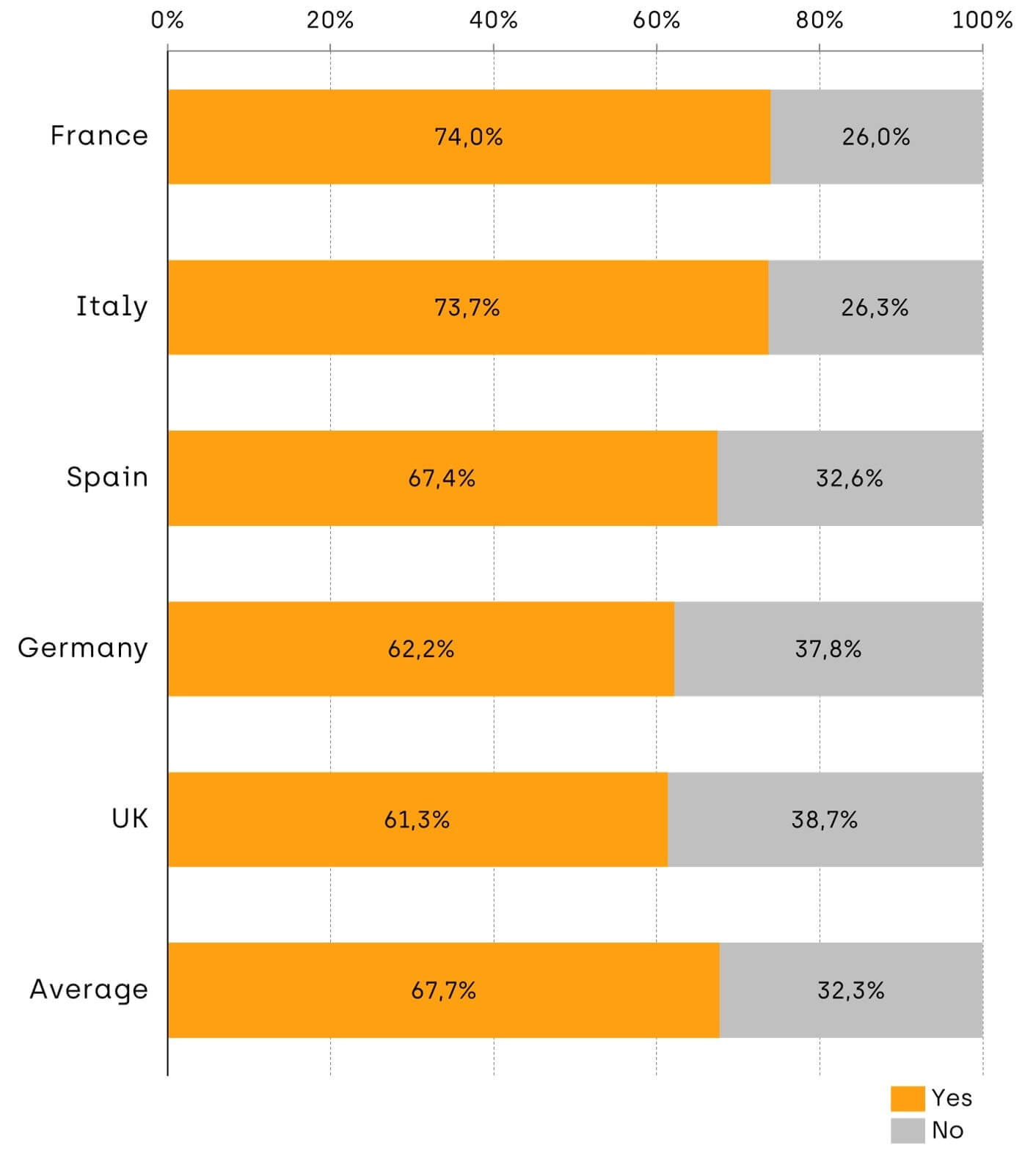

Key Statistic: 67.7% of consumers search for User Generated Content on social media before purchasing.

Key Learnings:

Key Summary: The younger the age, the more customers tend to read reviews.

Key statistic: 4.8% of all respondents claim to never read any customer reviews online. (Download full report to see this data)

Key Learnings:

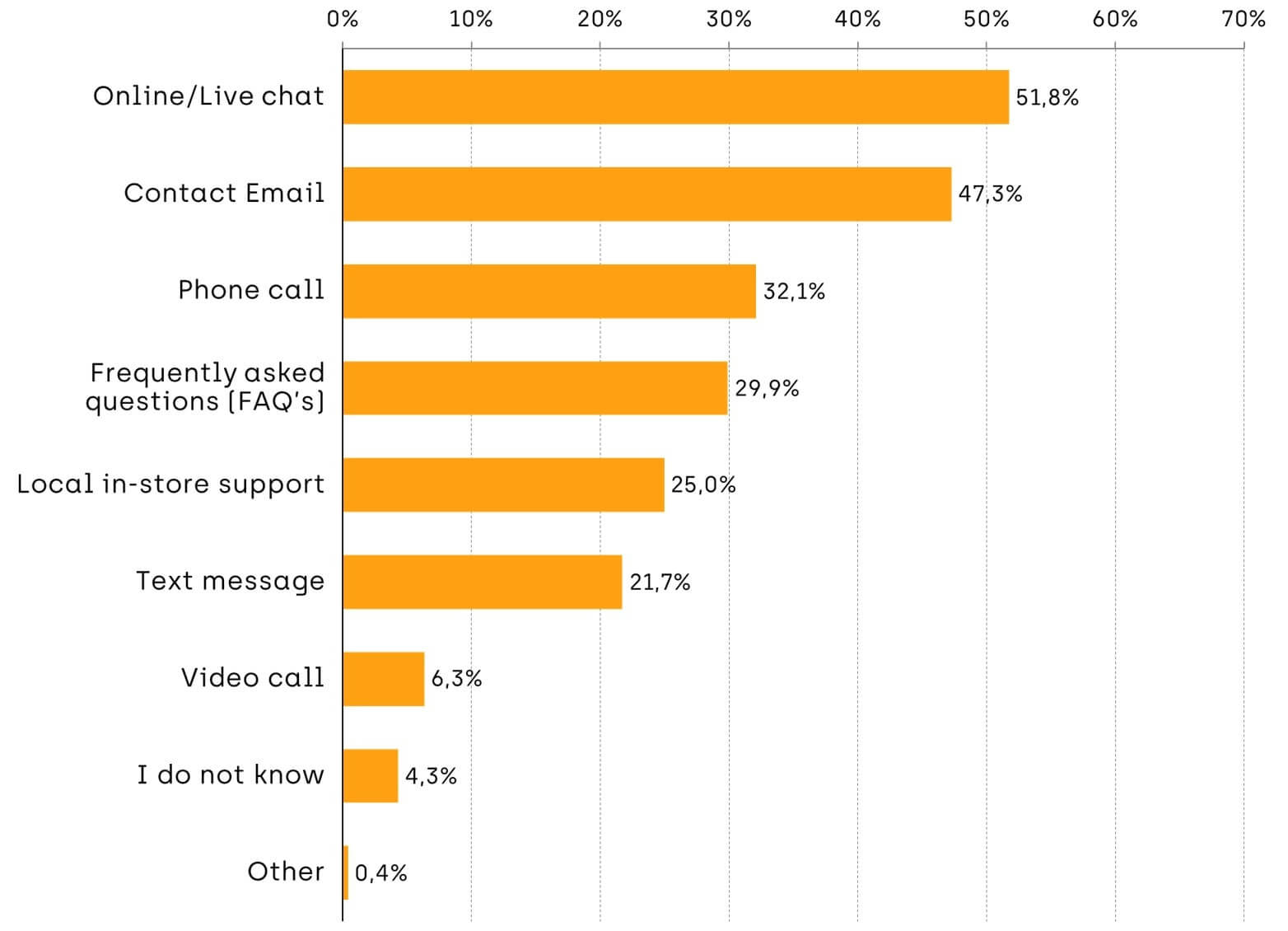

Key summary: Each country showed different results for contact features, which could be explained by cultural differences.

Key statistic: Over half of the respondents in all countries claimed online/live chat as their preferred form of help function.

Key Learnings:

Moving forward from this report, there are a few major points that online cosmetic brands can bring into their eCommerce strategies to enrich their online shopping journeys and – ultimately – sell more. Here are our recommendations based on the results of the research.

Keeping in mind the frequency in which customers make online cosmetics purchases will help you create a strategy that attracts clients to come back on a rolling basis. We can see that customers tend to buy cosmetics monthly, rather than daily or weekly, meaning that there should be strategies in place to hold their attention until that next month comes around.

Feel how you will about retailers, we can see that these spaces are stealing the spotlight in the eCommerce world. If your products are not already available through online retailers, it should be of increasing interest.

Based on our results, we can conclude that customer reviews and User Generated Content are powerful features within eCommerce. They are the modern day version of word-of-mouth marketing that consumers are growing more accustomed to seeing while shopping online. Without these features, brands risk losing customers to other companies that provide more of the information that they need to make an informed purchase. Not having these features can make your brand appear untrustworthy or as if there’s something to hide.

While it may seem like a big task, there are ways to streamline these strategies using tools like Trusted Shops (customer reviews) and Flowbox (User Generated Content). Not only do platforms of this nature make it easier to perform these strategies, they also help to increase eCommerce revenue. We take a look at how this can look in practice with our case study in the next section of the report.

If part of your business model is creating cruelty-free, recyclable products, then make sure your customers know about it. Based on our research, we can extrapolate that customers are becoming more concerned about issues related to the environment and their own personal impact. Brands can show customers that they are like-minded by developing cruelty-free products and by demonstrating their efforts to support a cleaner earth.

Show customers that your brand is committed to reliable communication by incorporating a chat feature into your eCommerce store. While it does mean that your team will have to be prepared to answer questions at all times, our data shows that eCommerce customers are becoming more interested in seeing this kind of communication.

By even having it as an option on your eCommerce, you’re telling website visitors that you are dependable and will respond in a timely manner. This sends a strong message from the start, even if they don’t actually use the service. Plus, this can be quickly and simply done using a platform like Drift.

We hope that based on our results, your online cosmetics brand can better understand which eCommerce trends are worth investing in. With a new year on the horizon, online brands should be focused on creating an innovative and exciting shopping experience – one that inspires customers to engage with it.

To get the full picture of our data report on the eCommerce trends within the cosmetics industry, download our PDF version here. Then, feel free to reach out with any questions related to the report.